Will Insurance Cover Back Braces And Other Spinal Orthoses?

Understanding Spinal Orthoses And Their Vital Role In Care

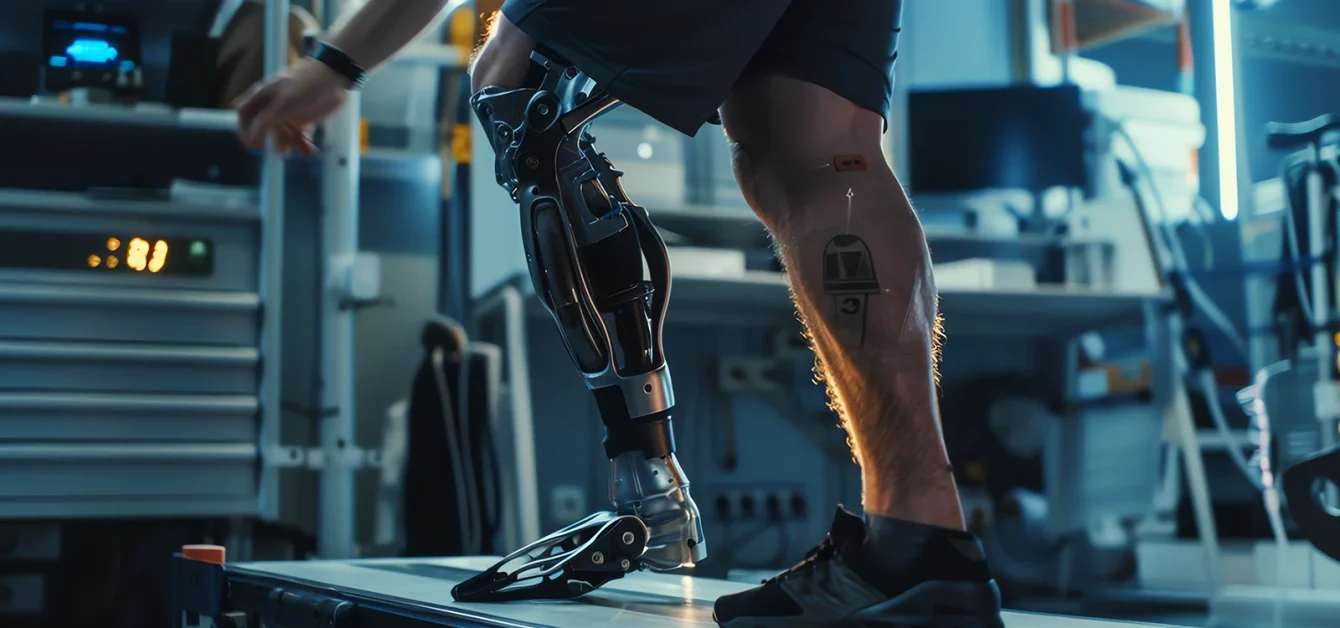

Spinal orthoses, commonly referred to as back braces, are medical devices prescribed to aid with spinal alignment, immobilization, or support during recovery from surgery or injury. By distributing weight and limiting motion, these devices play a crucial role in reducing pain, preventing further injury, and promoting healing. Because of their vital importance, many patients wonder whether insurance will help cover the sometimes substantial costs associated with spinal orthoses.

How Health Insurance Typically Approaches Orthotic Coverage

Most health insurance plans recognize the medical necessity of spinal orthoses when prescribed by a qualified healthcare provider. Coverage generally depends on the diagnosis, the effectiveness of more conservative treatments, and whether the brace is considered durable medical equipment (DME). Private insurers, Medicare, and Medicaid all have specific guidelines and requirements, which may include documentation of medical need and prior authorization before receiving the device.

Essential Steps For Ensuring Your Back Brace Is Covered

To maximize your chances of insurance coverage for a back brace, start by consulting with your physician and orthotist. They will document your diagnosis, treatment history, and the medical necessity for spinal orthoses. Submitting thorough and accurate paperwork is crucial; incomplete or imprecise documentation is a common reason for claim denials. When in doubt, contacting your insurance provider directly to clarify requirements can save time and frustration.

Navigating Out-Of-Pocket Costs And Insurance Limitations

Even if your insurance covers spinal orthoses, it’s important to be aware of potential out-of-pocket costs. These can include deductibles, copayments, coinsurance, or coverage gaps for specific types or brands of back braces. Some policies may only cover basic models, requiring you to pay extra for custom features or upgrades. Investigating your individual policy ahead of time helps you understand what to expect financially.

Tips For Appealing Denied Claims And Exploring Alternatives

If your initial claim for a back brace is denied, don’t lose hope. Insurance companies have appeal processes that allow you to submit additional documentation or request a review. Working closely with your healthcare provider can strengthen your appeal. Additionally, explore community assistance programs, nonprofit organizations, and manufacturer discounts that may help offset costs if coverage falls short.

Seeking Clarity And Support Along Your Insurance Journey

Understanding the nuances of insurance coverage for back braces and other spinal orthoses can feel daunting. Rely on your healthcare team, insurance representatives, and orthotic suppliers for guidance. Staying proactive and informed helps ensure you receive the support you need for your spinal health, minimizing financial stress and promoting your path to recovery or pain relief.